You have likely already started planning for your future and preparing to live independently. Maybe you’re planning to continue in full time education, travelling, or gaining qualifications on the job whilst working towards your dream career. Whatever your plans are, getting to grips with money will make it easier to reach your goals now and in the future.

Why Should You Learn to Budget?

Leaving home comes with expenses you’ve not needed to think about before, like paying for rent and other utilities. You may also be planning a holiday with friends or hoping to learn how to drive, things that come at a cost. It may feel like a challenge if you are on a small income or aren’t earning, but learning to budget now will prepare you for independence and help you achieve your dreams.

Benefits of Budgeting

- Whether it’s travel expenses and, in the future, housing, groceries, and broadband, budgeting will ensure you can pay for essential items and bills.

- Budgeting allows you to enjoy treats without worrying about being unable to pay for necessities.

- Careful budgeting will help you reach your saving goals.

- Budgeting will ensure you have enough spare cash for unforeseen expenses such as car repairs.

- Learning to budget now could prevent you from going into debt in the future.

- In the future, budgeting can build your credit score, which could help you buy your dream home.

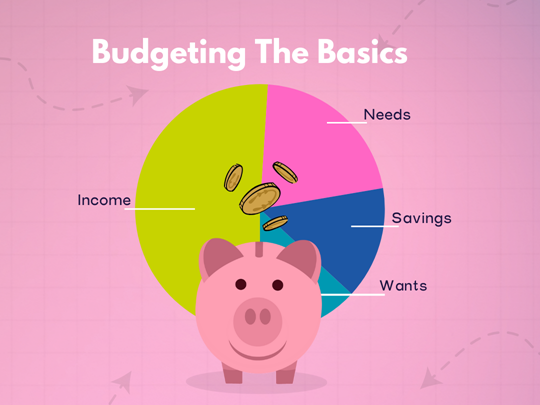

Budgeting Basics

Budgeting can sometimes sound more complicated than it actually is. The basic idea is to calculate your total income and subtract your essential spending. The amount you have left is your disposable income, money you can add to a savings pot or spend on treats and days out.

Building your budget

The key to a successful budget is categorising your spending into wants and needs alongside setting a savings goal.

As you still live at home, your foster parents will pay for the household bills and essential items. However, if you receive an allowance or work part-time and spend money on non-essential clothing, expensive skin and hair care products, entertainment and more, you’ll need to decide which are essential to you and which are more of a want.

If you want to buy an expensive item or save towards your own car, set yourself a realistic, time-bound savings goal and allocate some of your disposable income to it each month. When the month ends, if you have some money left over, you could pop it into your savings and reach your goal even faster.

Example Budget

It’s easier to stick to a budget if you have it written down and track your spending. So collect your receipts or look at your bank statements and either use a notepad or a budgeting app to record your spending and income. Over time, you’ll be able to see if you are sticking to your budget, understand where you spend your money and adjust your budget if needed.

Here is an example budget that you can use as a guideline to create your own:

Income |

Needs |

||

|---|---|---|---|

| Part-time Job | £300 | Haircare | £20 |

| Allowance | £50 | Skincare | £20 |

| Music streaming | £6 | ||

| Driving Lessons | £100 | ||

| Total Income | £350 | Total Needs | £146 |

Total Income £350 – Total Needs £146 = Disposable Income £204

Once you know your disposable income, you can decide how much you’d like to save and budget for wants. You can change your numbers to see how saving a little more each month will affect your saving goals. Be realistic about how much you can put away; otherwise, you may end up dipping into your savings to pay for your wants.

Savings

| Goal | Car |

|---|---|

| Cost | £3,500 |

| Target Date | 3 years |

| Savings per month | £100 |

Disposable Income £204 – Savings £100 = Remaining Income £104

Wants

| Goal | Car |

|---|---|

| Clothing | £40 |

| Meals Out | £30 |

| Cinema | £10 |

| Snacks | £10 |

| Total wants | £90 |

Remaining Income £104 – Total Wants £90 = Additional Savings £14

5 Ways to Make Some Extra Cash

If creating your budget leaves you wondering how you’ll meet your savings goals, here are five ways to make some extra cash.

Working part-time

If you don’t have one already, part-time jobs are the best way to earn extra cash. You can work from age 13, but only in specific roles like delivering newspapers, and there are strict regulations that your employer must abide by to protect your well-being and education.

When you turn 16, regulations are more relaxed, but you can only work for a maximum of 8 hours a day and 40 hours a week until you turn 18. Many employers offer flexible contracts, allowing you to reduce your hours during your exam season. You can also opt for a summer or Christmas temporary role if you’d like a break from work for some of the year.

Sell items you no longer use

Most second-hand selling platforms, such as Vinted and eBay, require you to be over 18. But, if you have a wardrobe crammed with clothes you no longer wear or a cupboard full of games you’ve outgrown, it might be worth asking your foster parents to sell them on your behalf. Any money you make can be put towards new clothes or added to your savings.

Online Surveys

If you spend your evenings scrolling social media, you could use that time to complete online surveys for cash instead. Companies are always looking for people to participate in market research, and you could earn a few extra hundred pounds per year to add to your savings pot. Just beware of websites that ask you to pay a registration fee; you don’t need to pay to complete surveys.

Pet sitting

If you’re an animal lover, you could offer to feed your neighbour’s cat while they’re on holiday or walk their dog after school for a small fee. Pet hotels and sitters are pricey, and owners often prefer leaving their pets with someone they trust, so it could be a great way to earn some extra cash.

Start a Side Hustle

If you’re creative and love making jewellery or painting, why not start a side hustle and sell your work at local markets and online? Etsy is forever growing as people hunt for one-off handmade items, and markets are a great place to showcase your talents. As with selling second-hand items, you must be 18 to open an Etsy account, so ask your foster parents to advertise your products for you. If your side hustle is successful, it could one day become a full-time career.

Now you know the budgeting basics, why not spend time creating savings goals and working out a budget?

Need a little help or advice?

Handbooks & Guides?

Are handy handbooks are designed with you in mind, full of helpful information for both you and your foster family.

Independents

Are you about to be independent or have you already left? Find support and information here and remember to stay in touch.

Have your say

We are here for you, have your say on topics you want to read, give us your feedback or contribute to your foster parent’s review.

Kids of Carers

We offer help and support to birth children and young people whose parents are foster carers.